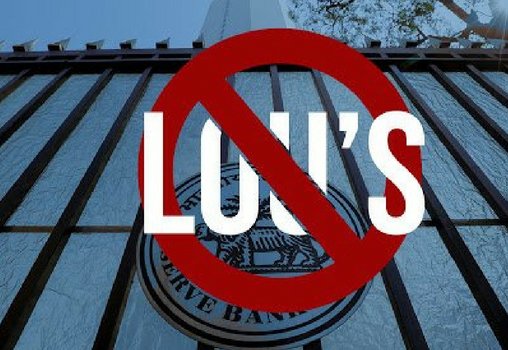

After the infamous Nirav Modi scam came to light, the RBI on March 14 decided to put a ban on LoUs – Letter of Understanding

What is LoU?

A Letter of Understanding (LoU) is a bank guarantee using which a customer can borrow money in the form of short-term credit from another Indian bank’s foreign branch abroad. This guarantee serves as proof that in case the customer cannot repay the loan, the issuing bank would assume full responsibility. Using LoUs, many importers could borrow loans abroad at a lower ban rate.

This ban has, however, put many small and medium enterprises in jeopardy.

SMEs Have Always Depended On LoUs To Meet Their Working Capital Requirements

In order to reduce their borrowing costs, importers in the past have mostly used buyer’s credit (LoUs) to meet their working capital needs. That’s because the cost of borrowing is linked to the London Interbank Offer Rate which is much more cost-effective.

According to the Hindu Businessline, as of March 31, 2017, the total outstanding buyer’s credit of the top 160 importers was over ₹330 billion. Out of which ₹312 billion of the credit was availed by large-sized importers, followed by small- and medium-sized importers (₹19 billion).

Further, they’ve also stated that the level of dependency on such buyer’s credit is inversely related to annual turnover of an importer. This means that if turnover is less, their dependency is more and vice versa. So small and medium-sized importers depend heavily on these LoUs and the ban on these might lead to sudden liquidity pressure and high funding costs for them. While large players can easily overcome this hurdle with alternative funding options, smaller players will find it difficult to secure funding.

Also Read: FACTORS TO CONSIDER BEFORE CHOOSING AN ONLINE SELLING PARTNER

What Some People Have To Say About This

President of Small & Medium Business Development Chamber of India, Chandrakant Salunkhe said, “Banning of LoUs will severely impact the SME sector as it was an important credibility building option for the smaller players.”

Nikunj Turakhia, President of Steel Users Federation of India, stated that this sudden ban by RBI will exert tremendous pressure on importers who have availed the facility because they will now have to shell out the entire money upfront. Usually, importers avail 90 days credit through Lou for which they are charged a margin at the rate of Libor (London Inter-bank Offered Rate) plus 1.5 – 2% besides submitting sufficient collateral.

Sandeep Parikh, Vice-President, Chamber of Small Industry Association, said that the small-scale units will face a liquidity crunch as payments from medium and large units will be delayed due to sudden cancellation of Lou. In all, about 10% of the small-scale units would be eligible and be using the Lou facility as buyers credit, he said.

Ganesh Kumar Gupta, Managing Director, Akash Textiles, and President, Federation of Indian Export Organisations, said “Since most exporters are using Letter of Credit and Bank Guarantees, which are relatively safe, the move will not have much adverse bearing on exports. However, this may slightly increase the cost as such instruments are costlier by about 0.5-1%.”

Rajesh Mehta, Executive Chairman, Rajesh Exports, one of the largest jewellery exporters, said that the knee-jerk reaction of the RBI has left scores of exporters in the lurch.

After receiving these representations from various corporates and banks against this sudden ban, the Finance Ministry has asked the RBI to give some breathing space to businesses to help them out.

Why SMEs Are Most Affected By This Ban

1. Their turnovers have declined: Chemtrols, which is a Mumbai-based industrial equipment manufacturer catering to oil refineries and fertiliser companies, expect its turnover to fall to ₹250 crore this fiscal from ₹350 crore logged in 2016-17. One of the reasons for this decline is due to the company’s business taking a toll after the ban because their cost of finance has risen from 5% to 13% post this ban.

2. It is difficult to get foreign financing: According to CFO of Raajratna Metal, before the LoU ban, foreign funds were accessible at 2.5% per annum but now the rate has become 10% per annum. Initially, they’d get $5-10$ mn through the LoUs but now the cost of these funds have risen massively as reported by the Hindi BusinessLine.

3. They have to cut down on raw material sourcing: Initially, for raw materials, companies would use Lou’s for 180 days at a low rate but now since procuring loans has become expensive companies need to resort to cost-cutting.

4. Doing business has become tougher: For borrowing loans companies need to submit collateral, go through strict processes and submit a lot of paperwork after the scam. All this has made business tough rather than easy! And people are questioning the entire ‘ease of doing’ business agenda.

Big companies can easily overcome the above problems but who will rescue the smaller fish in the pond? Can Fintech companies like FlexiLoans come to the rescue of these SMEs and solve their crisis? Will such SMEs resort to non-banking financial companies to solve their working capital needs, or will the RBI provide some relief to the genuine borrowers?